Best GST Tax Consultant in Ahmedabad

are you looking for Payroll Outsourcing

- Payroll Processing

- Statutory Compliance

- Income Tax Management

- Payroll compliance support

- PF & ESI Returns

- Professional Tax Return

LET'S TALK

Request a Free Quote

Payroll Outsourcing

PF & ESI Returns

- Provident Fund or PF is a social security system for the purpose of encouraging savings among employees and their retirement life.

- Contributions are made by the employer and the employee on a monthly basis. PF contributions can only be withdrawn by the employee at the time of his/her retirement, barring a few exceptions.

- All employers having PF registration are responsible to file returns on a regular basis. 25th day of the month is the last for employers to file in the PF return.

- Employers can now easily file Monthly PF Return Filing with the help of a unified portal.

Professional Tax Return

Every company which transacts Business and every person, who is engaged actively or otherwise in any Profession, Trade, calling or employment within the Town Panchayat on the first day of the half-year for which return is filed, shall pay half-yearly Tax.

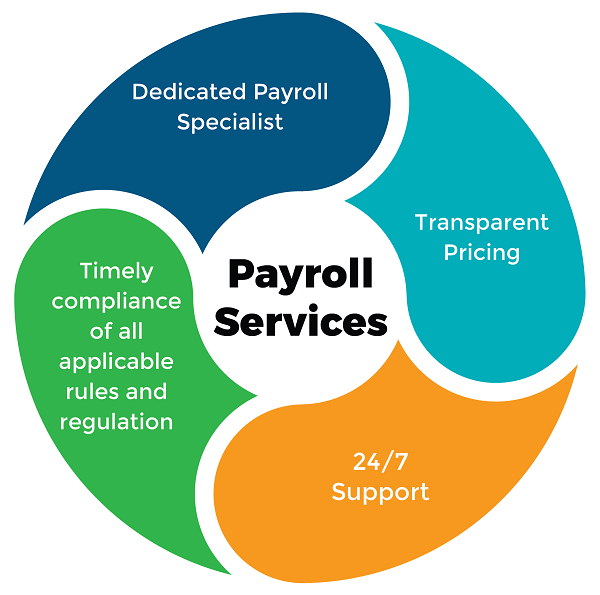

Benefits of Payroll Outsourcing

- Time and Resource Savings: Outsourcing payroll frees up valuable time and resources that can be redirected towards core business activities.

- Expertise: Payroll service providers are typically well-versed in tax regulations, compliance, and other payroll-related complexities, reducing the risk of errors and penalties.

- Accuracy:Professionals who specialize in payroll are less likely to make mistakes, ensuring accurate and timely paychecks for employees.

- Compliance: Outsourcing providers stay updated on changes in tax laws and labor regulations, ensuring that the payroll process remains compliant with legal requirements.

- Data Security: Reputable payroll outsourcing firms often have robust security measures in place to protect sensitive employee data

- Scalability: Outsourcing can easily accommodate changes in employee numbers, making it suitable for businesses with fluctuating staffing needs.

Why is it important to have payroll services handled by professionals?

Payroll management is a complicated process.

Calculating the salary of a single employee involves a lot of variables like gross salary, incentives, concessions, deductions, taxes and calculation of salary to be deducted for absence, uninformed leaves etc.

This is accompanied with legal compliances and additions or deductions such as EPF, TDS, ESI etc. that must be made according to current laws of taxation.

This definitely is a lot of work and there are high chances for errors if payroll is computed by an inexperienced or novice staff.

Mistakes made in calculation of payroll and non adherence to statutory laws can lead to levy of fines. This can also threaten the integrity of the Business if Tax officers get notified of the errors, calling for unwanted audits or the Business being terminated.

Payroll outsourcing company has many unique advantages as mentioned below

- Time and Money Saving

- Saving penalties for non-compliance

- Lower Risk Potential

- Direct Deposit of the pays

- Latest Technology used in the system

- Process Analytics

- Process Capabilities

- Data Confidentiality

We efficiently manage your employee payroll while you can focus on your core business activities. Our dedicated experts ensure accuracy, saving you time and resources.

Our highly capable professionals handle all statutory compliances (PF, ESI, PT & Form 16), from Annual to Monthly requirements, while ensuring accuracy and leaving you worry-free.

Payroll outsourcing refers to the practice of hiring an external company or service provider to handle various aspects of payroll processing and management on behalf of a business. This arrangement can offer several benefits to organizations, especially those looking to streamline operations and reduce administrative burdens. Payroll outsourcing involves outsourcing the entire payroll process, which includes tasks like calculating employee salaries, wages, taxes, deductions, benefits, and overtime.